Asphalt costs money, you used to pay for it when you bought gas. They have to collect it from somewhere.That's quite a few. We are encouraged to buy fuel efficient vehicles but then get charged for it.

Sponsored

Asphalt costs money, you used to pay for it when you bought gas. They have to collect it from somewhere.That's quite a few. We are encouraged to buy fuel efficient vehicles but then get charged for it.

I was not offered a discounted registration fee on my 2004 Ram 2500 that was getting 11 MPG and paying a lot more in road/fuel tax. This is not a good way to encourage hybrid and EV purchases.I'm in Ohio - I'd rather pay a flat fee than have the government monitor how many miles you drive.

I'm sure if your car is a "smart" car, they can already track your location and distance traveled 24 hours a day.

Fueleconomy.gov - if you drive 12,000 miles a year, you save $500 in gas in the hybrid vs. the Ecoboost. So make that $400 a year net savings if you are in Ohio....

Totally agree. Every mile is produced by fuel. I can understand plug ins and EVs but not hybrids.I kinda thing the hybrids should not be saddled with an extra fee. After all, every bit of energy they use to move on the roads is supplied from fuel put into the gas tank.

They just happen to be extra frugal in their use of fuel, and actually have been surpassed in their frugality by some models of Toyota and Honda, and perhaps some Chevrolet labeled Korean imports.

So you lead the way(sort of) in ecological use of petroleum fuel, and get popped in the chops for doing so with an extra fee above and beyond the road use taxes already paid.

I think some legislator got a bug somewhere, and wrote a bill that was discriminatory towards fuel efficient vehicles.

Do they also have an extra fee for the vehicles that get 42mpg or more on the EPA tests? If not, there is an opening for a lawyer to claim discrimination... great.

In GA, if you are elderly, the annual tag fee is decreased if you can attest to driving less than XXk miles annually. The will accept a statement of the odometer reading to reduce the fee. In the past, the annual emissions test required the odometer reading at time of testing. So, they know already how many miles you drive if you are required to get the vehicle tested. I remember CA SMOG testing as requiring odometer readings, and of course, when you transfer title, the odometer is also recorded. If they don't know, all the have to do is require odo readings for registration renewals.

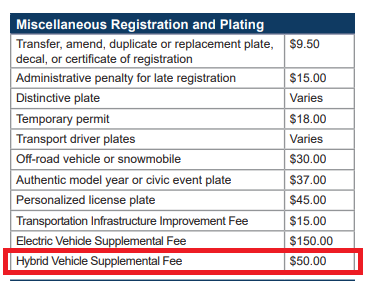

That's it! I'm moving to a hybrid friendly state.In Indiana the fee for hybrids is $50.00:

-You "could" have a state inspection station note the mileage every year (states that safety inspect).Tracking the mileage is the tricky part.

How do you:

- Track mileage without invading privacy

- Account for miles driven out of state

- Prevent people from cheating

I feel the same way. Not sure how much but I belive actually most of the fuel tax in NJ goes to subsidize mass transit. And I live in an are of NJ that has no mass transit. So I am paying for something I can't even use. And being a rural area we tend to drive more. So we pay more and get less. NJ has one of if not the highest cost per mile to maintain the roads. Everyone has their hand out, have to pay the union rate for any labor.To be honest, diverting fuel road tax to other purposes is something that bothers the heck out of me. My take is that every dime of road tax revenue should be used for road maintenance., both state and federal.

If bike trails and hiking trails are desired, then those that use them should help pay for them, rather than taking from the original intended purpose.

The same should hold true for mass transit projects and subsidies, they should not be taken from road tax revenue. IMO

GPS would work but then you get tax bills from every state you drive throgh. I think you will see chargers getting metered.-You "could" have a state inspection station note the mileage every year (states that safety inspect).

-GPS is in almost all cars nowadays- whether it's used for anything or not. Could report on shutdown how many miles were traveled in which state(s) to a sealed (without warrant) database.

-to prevent cheating you have to remove people from the equation. Automate it all so it's as tamper-proof as possible. (if GPS doesn't work, car won't run)

Definitely a possibility for dedicated EV chargers on the road. But what about home chargers / work chargers? I am 100% solar powered and would seriously resent them putting a meter on my array to charge me road tax.I think you will see chargers getting metered.

You COULD. Not sure I want to be around when that gets announced though-You "could" have a state inspection station note the mileage every year (states that safety inspect).

-GPS is in almost all cars nowadays- whether it's used for anything or not. Could report on shutdown how many miles were traveled in which state(s) to a sealed (without warrant) database.

-to prevent cheating you have to remove people from the equation. Automate it all so it's as tamper-proof as possible. (if GPS doesn't work, car won't run)